Global market share of the Beauty segment decreased 0. Due to the scale and scope of our business, we must rely on relationships with third parties, including our suppliers, distributors, contractors, commercial banks, joint venture partners and external business partners, for certain functions. Change in accounts payable, accrued and other liabilities. Excluding the impact of minor brand divestitures, organic volume increased low single digits. Securities registered pursuant to Section 12 b of the Act:. Core EPS is a measure of the Company's diluted net earnings per share from continuing operations adjusted as indicated. Assumptions used in our impairment evaluations, such as forecasted growth rates and cost of capital, are consistent with internal projections and operating plans. Core operating profit margin decreased 30 basis points versus the prior year, including approximately 60 basis points of negative foreign exchange impacts. We anticipate being able to support our short-term liquidity and operating needs largely through cash generated from operations. In the first step, we compare the fair value of the reporting unit to its carrying value. State of Incorporation: Ohio. Dividends per share. Fiscal Year Guidance The Company is projecting organic sales growth in the range of two to three percent for fiscal year Chief Brand Officer.

Net earnings from continuing operations. Although the resolution of these tax positions is uncertain, based on currently available information, we believe that the ultimate outcomes will not have a material adverse effect on our financial position, results of operations or cash flows. For additional details on the Company's income taxes, see Note 5 to the Consolidated Financial Statements. Determinable-lived intangible assets are amortized to expense over their estimated lives. Such contractual purchase obligations are primarily purchase orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends. In , we communicated details of an additional multi-year productivity and cost savings plan. Represents the U. Item 5. Purchase obligations 5. This was primarily driven by extended payment terms with our suppliers and an increase in fourth quarter marketing activity versus the prior year.

{{year}} Annual Report and Proxy Statement

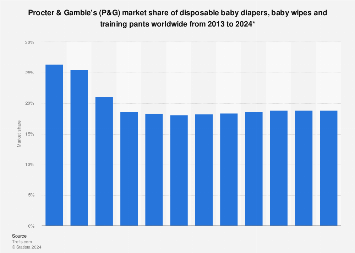

Oral Care organic sales increased low single digits due to product innovation, partially offset by the reversal of a U. Diluted net earnings per common share. As necessary, we may supplement operating cash flow with debt to fund these activities. Some of these patents or licenses cover significant product formulation and processes used to manufacture our products. Global market share of the baby care category decreased more than half a point. The consumer products industry is highly competitive. See Note 1 to our Consolidated Financial Statements. David S. Productivity improvement is critical to delivering our balanced top-line growth, bottom-line growth and value creation objectives. Gross margin increased driven by manufacturing cost savings partially offset by unfavorable foreign exchange impacts, lower pricing and unfavorable product mix across business units due to increased net sales in product forms and larger package sizes with lower than segment-average margins. United States. We compete in skin and personal care and in hair care. Volume increased mid-single digits in developing regions behind innovation and increased marketing. Tracey Grabowski.

PROCTER & GAMBLE Co (Form: K, Received: 08/07/ )

- As a multinational company with diverse product offerings, we are exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices.

- Excluding the impact of minor brand divestitures, organic volume increased low single digits.

- Volume in developed regions decreased low single digits due to competitive activity and trade inventory reductions.

- Oral Care volume increased low single digits.

- Our sales by geography for the fiscal years ended June 30 were as follows:.

- Free cash flow : Free cash flow is defined as operating cash flow less capital spending.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T §

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one pampers kaufland nl for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, and we pampers financial statements 2018 invest in the superiority of our products, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term, pampers financial statements 2018. Organic sales increased one percent on a three percent increase in organic volume. All-in volume increased two percent.

Pampers financial statements 2018. Press Release

.

.

Gross margin increased driven by manufacturing cost savings partially offset by unfavorable foreign exchange impacts, lower pricing and unfavorable product mix across business pampers financial statements 2018 due to increased net sales in product forms and larger package sizes with lower than segment-average margins.

2018 CHS Annual Meeting - Financial Report

0 thoughts on “Pampers financial statements 2018”